Nvidia First Public Company with $4 Trillion Capitalization

Nvidia makes history as the first public company to reach a market capitalization of $4 trillion.

This achievement confirms Nvidia’s dominance in the AI revolution era and reflects ongoing global financial dynamics. Nvidia reached the $1 trillion capitalization mark in June 2023, and since then its value has tripled in about a year.

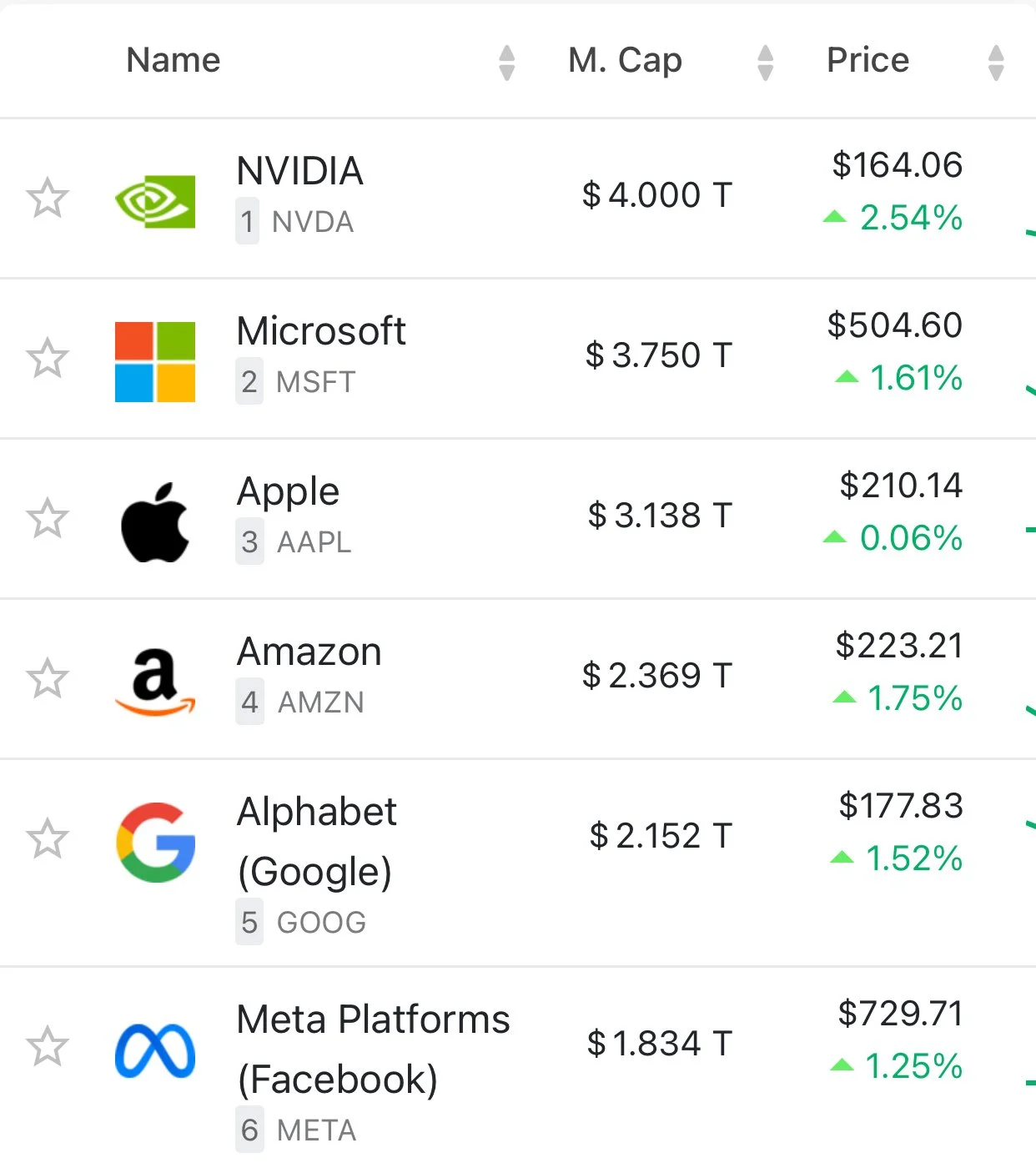

Currently, Nvidia’s valuation exceeds the total capitalization of the 216 smallest companies in the S&P 500, as well as surpassing Apple and Microsoft, which each have values around $3.9 trillion and $3.75 trillion respectively.

The surging demand for AI chips, especially the “Blackwell” series, drove Nvidia’s stock price up by 2–2.5% in early trading.

Nvidia’s chip products and software ecosystem are the backbone for training and developing generative AI models, and are widely used in hyperscale data centers.

- Stock Price Increase Since Early 2023 +1,000% (tenfold)

- Estimated Revenue Q2 2025 (May–July) ~$45 billion

- Annual Revenue FY 2026 (estimate) ~$200 billion (+50% YoY)

- Q1 2025 Revenue $44.1 billion (+69% YoY)

This revenue growth reflects Nvidia’s strength in meeting the growing need for AI hardware.

Export restrictions to China are expected to reduce Nvidia’s revenue by about $8 billion. The US government, especially during the “America First” policy era, also influences Nvidia’s supply chain and manufacturing strategy.

Nvidia’s stock volatility increased; in Q3 2024 it experienced a correction despite revenue growth and entering a more stable growth phase.

According to analysts, Nvidia holds a central position in the AI revolution; Microsoft is predicted to soon follow and reach a $4 trillion capitalization.

The emergence of the new Blackwell chip is the main focus for sustained growth. Analysts estimate Blackwell revenue will reach $62.6 billion in FY2026.

Nvidia’s current value represents 7.3% of the total value of the S&P 500, making it a major contributor to the index.

Nvidia has proven itself as the main engine of the global AI industry. With its innovative chip lineup and extraordinary financial strength, Nvidia is not only a technology pioneer but also a trendsetter in the capital markets. However, the journey to the top comes with challenges such as export regulations, geopolitical changes, and long-term valuation pressures.

Going forward, Blackwell’s achievements and supply chain strategy will be key determinants. If everything goes as planned, Nvidia will not only make history but also set a new benchmark for other technology companies.